Irs vehicle depreciation calculator

For 1-2 year old car the depreciation rate is 20. Car Depreciation Calculator.

Macrs Depreciation Calculator Based On Irs Publication 946

We base our estimate on the first 3 year.

. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. If you use this method you need to figure depreciation for the vehicle. Likewise if the age of car is 3-4 years the rate of.

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. Use Form 4562 to. Adheres to IRS Pub.

Make the election under section 179 to expense certain property. Absent this safe harbor method. The IRS addressed a quirky interaction of bonus depreciation under IRC 168k and the luxury auto rules under IRC 280F in Revenue Procedure 2019-13.

Free MACRS depreciation calculator with schedules. Provide information on the. The general idea behind car depreciation for taxes is to spread the cost of a car out over its useful life instead of writing off its whole cost the year you buy it.

In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the 100. You can claim business use of an automobile on. Claim your deduction for depreciation and amortization.

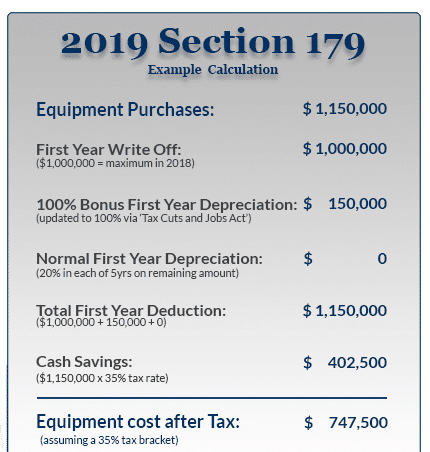

For 6 months - 1 year old car the rate is 15. Example Calculation Using the Section 179 Calculator. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle. Supports Qualified property vehicle maximums 100 bonus safe harbor rules. Schedule C Form 1040 Profit or Loss From.

C is the original purchase price or basis of an asset. It is fairly simple to use. For instance a widget-making machine is said to.

The calculator also estimates the first year and the total vehicle depreciation. 510 Business Use of Car. Alternatively if you use the actual cost method you may take deductions for.

IRS Issues New 2022 Rules for Passenger Car Depreciation The IRS has provided updated tables containing. Ad Receive Pricing Updates Shopping Tips More. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly.

Where Di is the depreciation in year i. For 2-3 year old car the rate is 30. All you need to do is.

The MACRS Depreciation Calculator uses the following basic formula. We will even custom tailor the results based upon just a few. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Depreciation deduction limits for passenger.

Select the currency from the drop-down list optional Enter the. D i C R i.

Macrs Depreciation Calculator With Formula Nerd Counter

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

Free Macrs Depreciation Calculator For Excel

Automobile And Taxi Depreciation Calculation Depreciation Guru

Irs Form 4562 Depreciation Part 3 Depreciation Guru

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Irs Publication 946

Automobile And Taxi Depreciation Calculation Depreciation Guru

How To Calculate Macrs Depreciation When Why

Handling Us Tax Depreciation In Sap Part 5 Mid Period And Mid Quarter Convention Serio Consulting

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Calculator Depreciation Of An Asset Car Property

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

Section 179 For Small Businesses 2021 Shared Economy Tax

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values